All sellers understand the importance of creating a sales pipeline and closing deals, but those who find consistent success also recognize the value of accurately calculating and managing pipeline coverage.

But too often, sales teams rely on outdated, fragmented point solutions or manual data-collection methods. These inadequate tools result in pipeline coverage gaps, rep underperformance, and surprise shortfalls. Over time, organizations fail to meet revenue targets. Until they can improve their performance, sales leaders lose their peers’ confidence.

To effectively deliver on winning strategies, sales teams require quality leads and revenue goals, both of which demand adequate pipeline coverage. Sellers need processes and tools to assess pipeline quantity, quality, and maturity to meet their targets.

Here, we’ll discuss everything you need to know about sales pipeline coverage ratio, including how to calculate it accurately, how much you need, and how to manage coverage to improve your productivity, performance, and predictability.

What is pipeline coverage?

Sales pipeline coverage is typically calculated and discussed as a ratio, which enables teams to understand the percentage of pipeline they’ll need to close to meet their sales goals.

Sales pipeline coverage is the ratio between the total dollar value of your sales funnel (all opportunities) and your revenue targets (the percentage you need to close). It’s a crucial tool that managers and reps use to evaluate the likelihood of meeting quota. For example, if your sales target for the quarter is $100,000 and the total value of your sales funnel for the same period is $250,000, your pipeline coverage ratio is 2.5.

You must know how to calculate pipeline coverage to manage it effectively. A weak ratio can help you spot early warning signs and take corrective action, while a strong ratio can indicate healthy strategies that your team should duplicate or standardize.

Watch our webinar “From Chaos to Clarity: 3 Ways to Transform Your Tech Stack”

You'll learn how Outreach and Zoom are helping revenue teams consolidate tools, boost productivity, and drive predictable growth.

How to calculate pipeline coverage

To measure pipeline coverage, you’ll need the total dollar value of your sales funnel and the total value of your revenue targets. The traditional formula sellers use to calculate sales pipeline coverage is as follows:

Pipeline coverage ratio = Total pipeline value ÷Total sales target value

For instance, if your total sales target value for the year is $1 million and you have a total pipeline value of $4 million, you would have 4X pipeline coverage. Your coverage ratio, then, would be 4:1, meaning that your total pipeline is four times your quota. In this scenario, your team would only need to close 25% of the pipeline to meet their sales goals for the year.

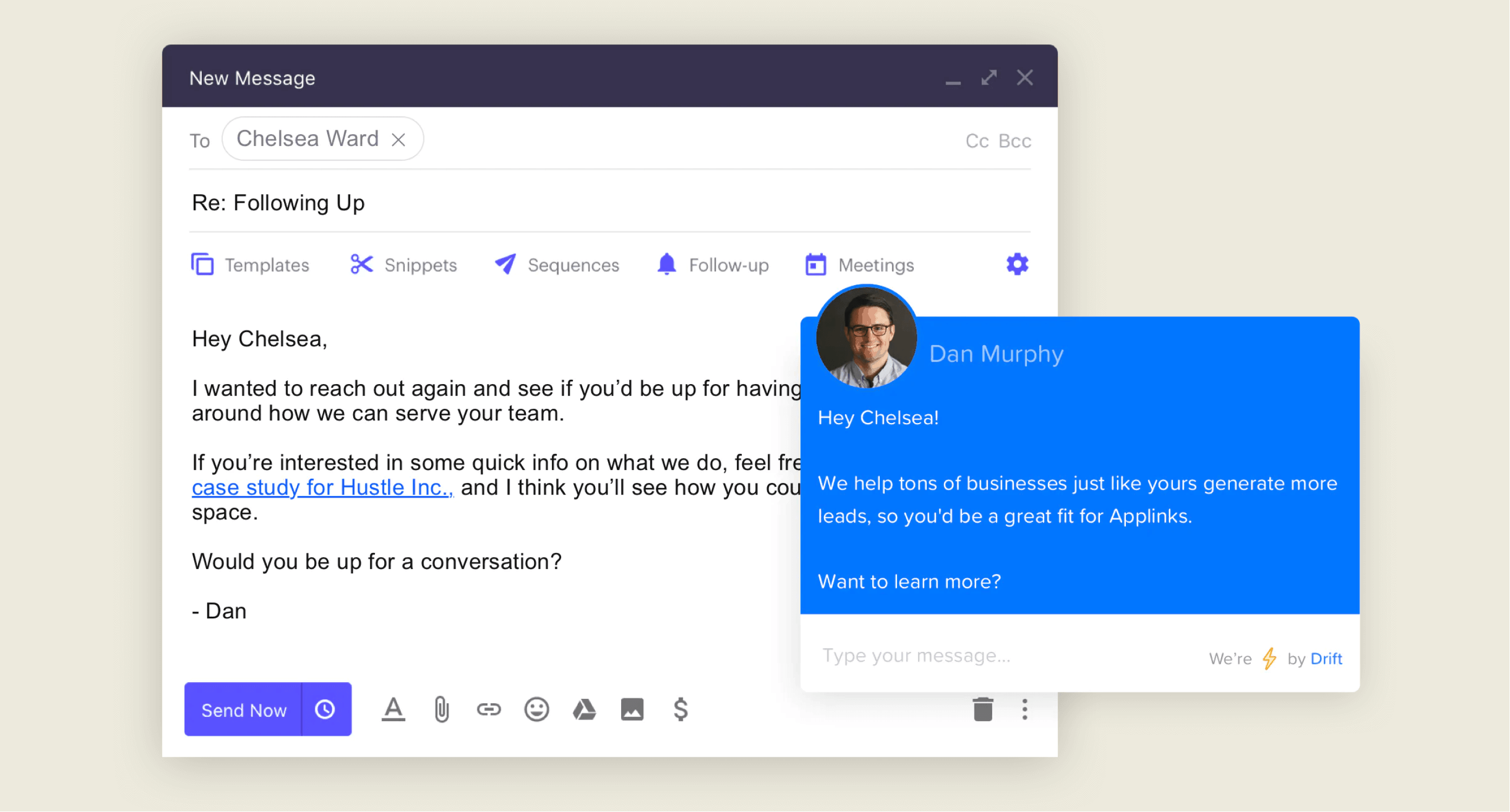

While some teams still calculate pipeline coverage using this formula, many now leverage sophisticated sales tools to calculate a more precise ratio. Sales execution platforms, for example, instantly capture data across the entire sales funnel and process, then automatically calculate pipeline coverage (among other valuable metrics) for a completely accurate, up-to-date measurement.

You should establish the ideal pipeline coverage for your business to help your team further refine their calculations. To know how much coverage you need, it is essential to have a good pulse on where you should be at any given moment.

The difference between weighted and unweighted pipeline coverage

When calculating pipeline coverage, it's important to understand the distinction between weighted and unweighted approaches. Unweighted pipeline coverage treats every deal in your funnel as if it has a 100% chance of closing, simply adding up the total dollar value of all opportunities. While this gives you a directional sense of pipeline volume, it doesn't reflect reality.

Weighted pipeline coverage provides a more accurate picture by multiplying each opportunity's value by its probability of closing, based on stage, historical win rates, or AI-driven predictions. For example, a $100,000 deal at the proposal stage (typically 50% probability) contributes $50,000 to your weighted pipeline. This weighted approach, often called "expected revenue," gives sales leaders greater confidence in their forecasts by accounting for the natural attrition that occurs as deals progress through the funnel.

Most modern sales execution platforms automatically calculate both unweighted and weighted pipeline coverage, giving you a complete view. Unweighted coverage helps you understand if you're generating enough top-of-funnel opportunities, while weighted coverage tells you if those opportunities are realistic enough to hit your targets. For the most accurate pipeline management, track both metrics and compare them regularly to identify gaps between opportunity volume and genuine revenue potential.

How much pipeline coverage do you need?

It’s important to note that there isn’t a single, one-size-fits-all method for determining the right amount of coverage for your business. Many sales and marketing managers collaborate with their senior colleagues or C-suite leaders to establish an ideal ratio. Others use a generic goal, such as 3X or 4X pipeline coverage, as a starting point.

While there's no universal standard, industry data shows typical pipeline coverage benchmarks vary by deal complexity and sales cycle length. Enterprise sales teams typically maintain 3-5x coverage to account for longer sales cycles and multiple stakeholders. Mid-market B2B teams often target 2.5-4x coverage, while high-velocity SMB sales may operate effectively with 2-3x coverage.

Your ideal ratio depends heavily on your historical win rate. For example, if your team closes 25% of qualified opportunities, you'll need at least 4x coverage just to break even. The key is analyzing your own data rather than blindly following industry rules of thumb.

Your sales team can also use sales activity metrics to help them improve their current pipeline, including:

- Average deal size - This metric is calculated by adding up the total revenue achieved in a given period (e.g., per quarter) and dividing it by the number of closed/won opportunities for the same timeframe.

- Average sales cycle length - The average sales cycle length refers to the amount of time it takes for an initial lead to become an actual paying customer.

- Customer acquisition cost (CAC) - Calculate CAC by dividing the sum of your marketing and sales costs by the number of closed deals during a particular time period.

- Qualified leads - While 61% of B2B marketers send all leads directly to sales, only 21% are actually qualified; so it’s crucial to standardize lead qualification and track how many qualified sales opportunities are in the pipeline at any given time.

- Win rate - To calculate win rate, divide the number of closed/won deals by the number of opportunities created during the same timeframe.

Each of the above metrics will help your team keep tabs on all the moving parts within the pipeline and use this information to maintain a healthier pipeline. Over time, this analysis will give leaders a deep understanding of all active deals and identify anything that may be slowing them down. From there, they can more easily determine a pipeline coverage ratio that makes sense based on their unique business’s data.

Once your team establishes the right pipeline coverage ratio, they can perform more focused calculations for specific sales opportunities.

Understanding what your pipeline coverage ratio reveals

Your pipeline coverage ratio isn't just a number. It's a diagnostic tool that reveals the health of your sales process and helps you identify where to focus your efforts.

Low pipeline coverage (below 2x) is a red flag that demands immediate attention. This typically signals one of three problems: inadequate pipeline generation from both marketing and sales development efforts, weak lead qualification allowing unqualified prospects to consume sales resources, or unrealistic quota targets that don't align with market conditions and historical performance.

When you spot low coverage early in a quarter, you have time to course-correct by ramping up prospecting activities, revisiting your ideal customer profile, or reallocating resources to higher-performing channels.

Excessive pipeline coverage (above 5x) isn't always cause for celebration. While it might seem safer to have more opportunities, an inflated pipeline often masks serious problems. Sales reps may be padding their pipelines with low-quality prospects to appear busy, or the pipeline may contain stale deals that have been sitting for months with no real buyer intent.

This bloated coverage creates false confidence in forecasts and prevents teams from focusing on the deals most likely to close. Regular pipeline hygiene practices, like removing opportunities that haven't progressed in 30-60 days, help maintain an accurate coverage picture.

The sweet spot is maintaining coverage that matches your historical win rates while ensuring every opportunity represents genuine buyer interest and has clear next steps. This requires consistent pipeline reviews and honest conversations about deal quality, not just quantity.

What’s the difference between pipeline coverage and forecast coverage?

Accurate forecasts lean heavily on the sales pipeline as their foundation. While pipeline coverage illustrates the various potential customers as they move through different stages in the buyer's journey, forecast coverage offers a more detailed view of each individual sales opportunity. Forecast coverage is a weighted measurement that uses historical win rate data and your quota for a given timeframe to determine how much of your pipeline is covered by your forecast.

Let’s say, for example, that your sales target value for this year is $1 million and you have 4X pipeline coverage, or a 4:1 pipeline coverage ratio. You’ve applied historical win rates to that same pipeline and have calculated a forecast of $600,000 for the year. Therefore, your forecast coverage is 60%.

By monitoring their pipeline coverage consistently, sales teams can make more accurate forecast coverage calculations, which enables more confident, reliable predictions for future sales.

How often should we measure pipeline coverage?

While the frequency at which your team should measure their pipeline goals will depend on your business needs and goals, there are some best practices you can follow as a general guide.

For instance, reviewing coverage on a daily basis and establishing a regular interval to measure current and future coverage (e.g., once a week) is a great way to familiarize yourself and your team with up-to-date realities and expectations. This is a time-consuming, burdensome feat without the proper tools, but a sales platform can help managers and sellers use historical data from every part of the pipeline to quickly perform these measurements.

In fact, the right sales technology can automatically collect and analyze accurate, up-to-date data and enable your sales and marketing teams to use their pipeline coverage ratio efficiently, rather than wasting time manually pulling data that, without the right tools, is often incomplete. Powerful sales tools ensure accurate, up-to-date results and complete visibility into the pipeline.

How to manage pipeline coverage

Your pipeline coverage is an excellent diagnostic tool for understanding the health of both your sales pipeline and process. Implementing and fine-tuning your strategies based on your pipeline coverage can help you identify what’s working, what’s not, and course-correct at-risk deals before it’s too late.

Only 30% of B2B organizations say they're properly equipped to use their data to improve their strategies. Investing in a data-driven approach to pipeline coverage can become a true competitive advantage. To do this, sales leaders must collaborate to create plans and goals that reflect accurate, up-to-date pipeline coverage calculations.

This is especially critical if your business has multiple sales teams with different pipelines. Training your sales teams to pursue opportunities based on precisely calculated pipeline coverage ratios and goals empowers them to focus their efforts on the highest-value areas.

To monitor their sellers’ effectiveness, sales leaders can measure team members’ progress based on pipeline quality, quantity, maturity, and coverage gaps. This requires two things: a well-implemented CRM and a centralized sales execution platform that brings transparency, real-time access, and up-to-date data together in a single, user-friendly place.

Equally important is maintaining pipeline hygiene by regularly removing stale opportunities, updating probability percentages as deals progress or stall, and ensuring every opportunity in the system reflects genuine buyer intent and has clear next steps.

4 common pipeline coverage mistakes to avoid

Even teams that regularly track pipeline coverage often make critical mistakes that undermine the metric's usefulness. Avoiding these common pitfalls will help you maintain a more accurate and actionable view of your pipeline health.

- Ignoring opportunity stage and maturity. Calculating coverage without considering where deals are in the buying cycle creates a false sense of security. A pipeline heavy with early-stage prospects requires much higher coverage ratios than one filled with late-stage opportunities. Smart teams segment their coverage analysis by stage to understand if they have enough qualified pipeline at each phase of the sales process.

- Including stale deals that artificially inflate coverage. Many pipelines contain "zombie deals" that have sat dormant for months with no meaningful buyer engagement. These opportunities inflate your coverage numbers while providing zero real value. Establish clear criteria for when to remove or downgrade stale opportunities, such as no activity in 45-60 days or repeated no-shows to scheduled meetings.

- Applying a universal ratio without considering your win rates. The 3x or 4x coverage rules of thumb only work if they align with your actual conversion rates. If your team closes 40% of qualified opportunities, you need far less coverage than a team closing 20%. Calculate your ideal ratio based on your historical win rate data, not generic industry standards.

- Failing to segment by territory, rep, or deal type. Different sales motions require different coverage levels. New market territories need higher coverage than established regions. Enterprise deals with longer sales cycles require more cushion than transactional sales. Top-performing reps with higher win rates can operate with lower coverage than newer team members. Segment your coverage analysis to set appropriate expectations for different parts of your business.

Create and manage your pipeline with Outreach

Calculating and using your pipeline coverage ratio based on complete and well-analyzed data is vital for establishing winning sales and marketing plans, identifying opportunities, and closing deals. But without the right tools, leaders and sellers struggle to ensure there’s sufficient coverage to develop effective strategies and deliver on their goals.

Outreach’s pipeline management capabilities help sales and revenue operations leaders maximize their sales pipeline coverage. With tools that offer an uninhibited view into pipeline coverage, including built-in win modeling, at-risk deal spotting, and full opportunity history, Outreach can help your team understand, accurately forecast, and seamlessly execute on their sales pipeline.

Master the KPIs that drive consistent quota attainment

The pipeline coverage strategies above only work with accurate metrics and benchmarks. Access the complete checklist of basic and advanced KPIs that best-in-class sales organizations use to maintain healthy coverage ratios, diagnose pipeline gaps, and ensure predictable revenue. Plus, Outreach users get bonus metrics to further optimize their pipeline management.

Frequently asked questions about pipeline coverage

What's the difference between pipeline coverage and forecast coverage?

Pipeline coverage measures all opportunities in your funnel against quota, while forecast coverage applies win probability to create a weighted prediction. Pipeline coverage answers "do we have enough volume?" while forecast coverage answers "how much will we actually close?" Both metrics work together to give you a complete picture of pipeline health and revenue predictability.

Should I track pipeline coverage at the individual rep level?

Yes. Rep-level pipeline coverage helps sales managers identify who needs coaching on prospecting versus who should focus on closing existing deals. It fosters individual accountability and lets you set personalized coverage targets based on each rep's win rate, territory maturity, and experience level.

What if I have high pipeline coverage but still miss quota?

High coverage with missed quotas typically indicates one of three issues: poor pipeline quality with too many unqualified leads, inadequate sales execution and deal progression, or overly optimistic opportunity values that don't reflect reality. This is where weighted pipeline coverage and win rate analysis become critical diagnostic tools.

How does pipeline velocity affect my coverage needs?

Faster sales cycles require less coverage because you can generate and close opportunities more quickly within a given period. Conversely, complex enterprise sales with 6-12 month cycles need higher coverage to ensure you always have enough mature opportunities approaching close. Factor your average sales cycle length into your coverage targets, and increase coverage requirements as cycles lengthen.

Stay up-to-date with all things Outreach

Get the latest product news, industry insights, and valuable resources in your inbox.