With the sudden investment slow-downs in reaction to economic uncertainty, organizations are seeing pipeline health and volume decline, putting forecast accuracy and revenue predictability at risk.

In uncertain times, businesses can’t tolerate inefficient, inaccurate forecasting processes. Deals that are lost or slip impact revenue delivery, yet consistent target attainment is what makes the business run.

On the flip side, an accurate forecast doesn't mean much if it doesn't deliver on the revenue required to keep the business afloat or invest in strategic growth. With increasing competition and consolidation across industries and markets, each loss has an impact. Not knowing how to course-correct, or being too late to do so, is every revenue leader’s nightmare.

When every deal matters, RevOps leaders can’t afford to miss their numbers. So why is forecasting so hard to get right?

Keep reading to learn more about:

- Why sales forecasting matters

- Why traditional sales forecasting is inherently flawed

- Common challenges RevOps and Sales Ops teams are facing

- What you should consider when assessing your forecast process and how to improve it

- How we improved our forecast process and inefficiencies with Outreach Commit

Why sales forecasting matters

Think of forecasting like going on a road trip: you’re driving from Miami to Seattle, but unless you’re in the back of a chauffeured car, you don’t just get in and fall asleep. You’re checking the GPS, the fuel gauge, the road signs, the weather, your snack compartment, etc. along the way.

Similarly, in forecasting, you’re starting a given time period by calling a revenue number. Along the way, we’re checking the relevant data points and metrics to ensure we are going to hit our destination.

Forecasting gives you a leading indicator for where you will finish the quarter or the year, depending on your sales cycles and business model. If you miss your targets, you need to know early so that you can make necessary adjustments as you go.

Accurate forecasting helps you gain an edge in the market. Let’s say that you’re forecasting to overachieve and the business is confident in the number you’re putting forward. Maybe you can hire those extra developers a quarter or two earlier than anticipated and get started on differentiators that’ll put you in a better place in the market long-term.

Ultimately, accurate forecasting is foundational for business continuity — especially during times of economic turbulence.

Why traditional sales forecasting is inherently flawed

Traditional sales forecasting is inherently flawed because it is a sum of its parts. Even in organizations that adopt a bottom-up forecasting approach, the baseline assumption is that every process is being adopted and adhered to uniformly. If you drive the same route to work every day for 30 years, you’re going to catch different red lights on different trips, or speed more on days that you’re running behind schedule.

It’s also not the first thing organizations think of when they’re starting out; it’s often a process they implement after they’ve reached a certain size. To continue our driving to work analogy, this is somewhat equivalent to forcing every car that you encounter on your daily commute to permanently drive a different way after a few years of their preferred route.

In organizations that have a forecasting process and rhythm, there’s still the reality of manual inputs of limited data in Salesforce or Dynamics; and those inputs are still just a snapshot of one individual’s view of how the deal is progressing. Even the best note-takers (and let’s be honest, most sellers are not logging all of their notes in the CRM) are a one-sided reflection of what’s happening in the sales cycle. Not to offend any sales leaders out there, because there is truly an art to sales forecasting, but currently, forecasting is very often a gut feel number.

With all that sales leaders are asked to do, and current economic uncertainty, relying on gut feel will not provide the revenue accuracy that businesses and markets demand.

Common challenges RevOps and Sales Ops teams are facing

The biggest challenge around data is that it’s either manual or missing, or both. That matters to RevOps because we’re responsible for defining and iterating on processes for the revenue organization, which includes the forecasting rhythm.

We need to know if the prospecting process is delivering pipeline as expected, to inform adjustments to target KPIs, or even the amount of people we hire. Once that pipeline is created, then we’re also assessing whether it’s converting at the rate and velocity that the business needs. If there are areas of weakness, we need to know what’s happening. Is there a certain team that’s converting at a lower rate because they’re carrying more new sellers? Are inbound leads driving an unexpected influx of faster-moving deals in one segment?

Trying to answer those questions and be truly strategic partners to the business often means you spend hours and hours pulling data from different systems and parts of the organization into a massive spreadsheet. The time it takes for RevOps leaders to closely edit a spreadsheet to ensure there’s not one mistyped digit or accidentally erased cell becomes an extremely cumbersome and inefficient use of time.

Poor forecasting processes leave you without fidelity or accuracy in the number you’re committing to the business, which makes it nearly impossible to sustain business or grow.

You often see this lack of scalable, defined process come to light at the end of the quarter when you’re scrambling for revenue. From a process and longevity perspective, even if you blow your number out of the water, not landing where you said you would or hitting your number with a different set of deals is an indicator that you don’t have a handle on what’s happening in the business.

That opens the door to more risk than most organizations and stakeholders are willing to tolerate.

What you should consider when assessing your forecast process and how to improve it

When assessing your forecast process and how to improve it, start by assessing whether there is a clearly defined process:

- Is your process documented and shared with the organization?

- How complex or simple is it?

- Does the process map to the stage you’re at?

Don’t do this in a silo either — make a point to understand whether the organization is actually following the process and what’s working well or going poorly. If you haven’t performed an assessment of the current state, you’re not ready to move forward with improving the forecasting process. These initiatives often become a priority after a poor quarter or a massively inaccurate forecast, which can make it difficult to push back on the timeline for delivering an improved process. You can’t skip over this piece or you’ll end up back in the same spot again.

Once you’ve assessed where you’re at, focus on starting with small changes and improvements to ensure the change management is accepted by your organization.

Radically changing what is in place can lead to a lack of adoption or frustration. Setting expectations on an iterative approach to process change will set you up for success.

Metrics that should inform your forecast

There are two ways to think about which metrics should inform your forecast — metrics that are tied to the call you are going to make within your forecast and whether the forecasting process is working.

These metrics help inform your forecast call:

- Pipeline generation

- Pacing week over week or quarter to date

- ACV

- Pipeline source

- Product

- Segment

To measure whether or not your forecasting process is working, measure forecast accuracy by comparing your actual results compared to your projected results. If you’re widely off — say plus or minus 20 to 30 percent — you’re not running a tight forecast process.

Using a forecast maturity model

Maturity models are a common framework we use for tech roll-outs, process changes, and even our overall go-to-market approach. The forecast maturity model helps us articulate where we are and where we’re headed, and prioritize accordingly.

We realized it’s nearly impossible to progress past stage 2 (ie. reactive forecasting with visibility into maybe one to two months out at best) without a revenue operations solution like Outreach Commit.

With our desire to grow the business, we needed to free our sales leaders up to focus on moving deals forward and our RevOps organization on a world-class customer experience.

How we improved our forecast process and inefficiencies with Outreach Commit

At Outreach, we use Outreach Commit to make sure that our forecasts are accurate and consistent. This helps our team deliver revenue in a predictable way, no matter what’s happening in the market.

One of the great things about Outreach’s revenue operations solution Outreach Commit is that it solves for the spreadsheet nightmare that I mentioned earlier. Instead of allocating inordinate amounts of time to aggregating data for forecasting, which is inevitably outdated as soon as it’s pulled out of the disparate systems, we have a single pane of glass that does this for us.

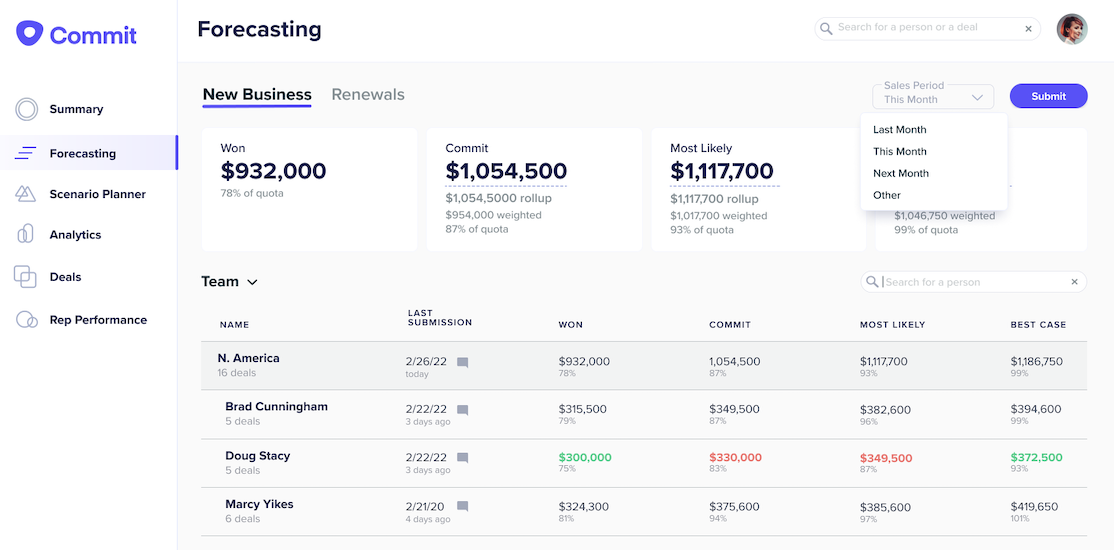

For example, with the forecasting module in Outreach Commit, you can view the roll-up forecast at every level of your organization.

You can view:

- What has been won to date in the forecast period

- How much business you have open

- Whether your gap coverage is sufficient to make up for any shortfalls between your won and open business

You can also see how much mid-quarter business you might expect to land. This represents deals that are not yet on your radar that might open and close within the time left in the forecast period — deals that are notoriously hard to account for.

Not only does Outreach Commit bring the full picture together, but it also shows us what’s changed at the deal and pipeline level any time we’re looking, in real-time.

Outreach Commit also takes the burden of manual inputs off of our selling teams, from individual AEs all the way up to our CRO. Outreach’s machine learning models pull in all of the activity data, the intelligence of buyer sentiment and engagement, and historical performance to deliver stronger projections.

Because it’s flexible enough to fit into our processes across the organization, sellers can edit the opportunities in Outreach Commit as they’re doing their deal review and it will write that back to the CRM so nothing slips through the cracks or gets lost in a spreadsheet.

Often in forecasting we want to run various scenarios to understand forecasts for future quarters or where we will land the current quarter. Scenario Planner in Outreach Commit lets us see the math behind every prediction and adjust forecast model assumptions to compare scenarios. For example, if you are short on pipeline for the quarter you can use Scenario Planner to see what win rates you might need to achieve at each sales stage to still hit quota. Not having to update or collect data for every scenario manually has been a game changer for being able to get a handle on our current and future quarter forecasts.

The flexibility of Outreach Commit is what really differentiates it from other solutions, and it’s what makes it easy to adopt for both RevOps and the selling teams.

Execute with confidence now

Most solutions on the market, especially in sales and marketing technology, will promise you that they’re going to single-handedly solve all your problems. Yes, you’ve got to choose the right solution for your business, but you can’t skip over the process and planning pieces or you’ll have the equivalent of a really expensive typewriter in an attic somewhere.

Running a leading RevOps organization isn’t about having the shiniest new toy or hordes of resources. It boils down to planning, process, technology, and continually iterating on those and how they interact to drive business results.

Request a demo to learn more about how Outreach Commit takes the guesswork out of revenue forecasting so you can execute with confidence.